07 Nov The Tacoma Narrows Bridge and the US Financial Structure: A Common Theme

A cautionary tale about finance

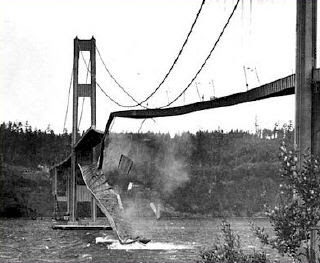

The collapse of the Tacoma Narrows Bridge, due to unforeseen resonance effects, is more than a watershed in the history of bridge design and civil engineering. It is an object lesson in the need to fully understand a problem before designing its solution.

Bridges and airplanes represent decades or centuries of know-how handed down to us in the form of physical theories and engineering standards. The same would be true for finance, if we did not have such a high tolerance for violating the trust and wasting the wealth and savings of others.

The main reason why the architects of deal disasters not only survive their mistakes but go on to create new ones is that deal “blow ups” lack tragic and visible consequences. But, if fumbling financiers were held as accountable for their structures as fumbling bridge-builders are, the field of finance would soon become a science as precise as bridge building.

Accountability is only possible where there is feedback. Financial feedback is not measured in terms of body count or ruins at the bottom of Puget Sound. It consists of broken promises, wasted money and squandered opportunity. Financial loss can only be quantified in light of the original promise to pay. That promise can only be understood by understanding the deal itself.

The way of the deal has never been specified formally because the question of the deal has never been posed, let alone answered. The question of the deal is not the most important question in finance. It is not even the most significant question in finance. It is the only question in finance. It is the reason why you are here.