02 Feb China Understands The Limits Of Financial Engineering

When China published “Some Measures to Expand China’s Openness and Aggressively Utilize Foreign Investment Capital,” a lightbulb went on in my head: China finally “gets” the limits of financial engineering and will return to first principles.

Deng Xiaoping is still the name most closely associated with China’s push for modernization, but it was Zhou Enlai in 1963 who talked up the Four Modernizations (Agriculture, Industry, Defense and ScienceTechnology). After Mao, Deng connected the dots between opening China’s economy and acquiring Western knowhow, and he added a fifth sector to China’s list: finance. The 40year dominance of his thinking over China’s economic landscape may be why many Western observers have linked its openness with financial modernization. But this has always been China’s choice. It is not a logical necessity.

Economist Arthur Kroeber compared the decoupling of these two agendas to watching a “very slow train wreck.” Yet, in precisely the same time frame, China accelerated its Herculean efforts to modernize its domestic financial system architecture. Digital payment systems, adoption of a registration system for securities, exchangelisted ABS, central bankled digital payment clearing systems, ETFs, all mushroomed after President Xi took office in late 2012.

As a frequent speaker to senior regulatory officials and bankers from China, I have been asked to give insights into many topics from finance’s cutting edge: derivatives, securitization, private wealth products, crowdfunding and the perennial favorite, financial innovation: What is it? How can China bootstrap it? In my mind, the case for financial engineering in building national wealth has yet to be made. Market risk engineering guru Rich Bookstaber blinks. In his definitive study on the technical roots of crisis, A Demon of Our Own Design: Markets, Hedge Funds and the Perils of Financial Innovation, his very best advice is “be careful.” Even China’s elder statesman economist Cheng Siwei, an expert in complexity and China’s virtual economy, warned of the relationship between financial engineering and crisis in late 2014, a few months before he passed away.

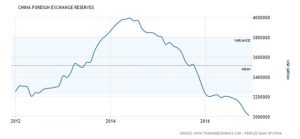

It is fair to say financial engineering has brought China to its present economic inflection point. After the Yuan rose from 7.5to1 to about 6to1 ($0.167) between 20082014, it lost about twothirds of its gains, ending in 2016 at 7to1 ($0.143). Meanwhile, to keep inflation at bay, China’s central bank sold dollars and bought Yuan, dropping its FX reserves (which function like a cash reserve account in a structured balance sheet) by 25%, from $4 trillion USD at its peak in 2014 to about $3 trillion USD now—the average level of reserves postcrisis, but well below the average while Xi has been in office and poised to drop further.

The Yuan has been caught in a seesaw, with one side claiming manipulation to juice China’s export earnings while the other claims it is propped up to please the IMF and placate the West. Such onedimensional debates contain a grain of truth, but they lead us away from “fair value.”

A national economic balance sheet—not the paper one, the real one—is a nonlinear, or complex system where money links up the assets, liabilities and capital stock of public and private enterprises. Fair value is the ensemble of capital costs over the predictable future that can align assets, liabilities and equity to generate lowvolatility, selfsustaining growth. For any nation, that would be a delicate balancing act. But China must balance the wealth expectations of its citizens against the commercial expectations of its foreign relationships, and against the material constraints of an economy with vastly uneven rates of regional development.

China has been using all the traditional tools of financial engineering at its disposal to grow, at a speed that is physically impossible. Hence the seesaw. Now China wants to add the most powerful tool of all: quality. That could be a gamechanger.

-Ann Rutledge, CSC