Ratings on Seasoning Deals

To update the ratings on seasoning tranches, CSC first replicates the dynamic equilibrium of the transaction when it first went to market, so that the modeled AAA tranches meet the numerical definition of AAA on the CSC scale—i.e., their reduction of yield is 0.05 bps.

From that result, CSC obtains the collateral short-rate volatility. It is a direct, transaction-specific measure of the yield AAA-investors demand for the collateral risk they are taking on. This step is called calibration. CSC then updates the pool’s set-up parameters to reflect changing dynamics so that the ratings remain fresh and reliable.

Fixed-income instruments have optionality: over time, the borrowers may default or prepay. But this optionality decays with the passage of time: a borrower only prepays in full or defaults a maximum of one time in the deal. Since collateral risk is decaying, the credit quality of structured securities is either getting better as it goes away—or worse. It cannot remain the same.

Thus it is necessary to measure the changing credit quality using numbers—and also it is possible to measure the change because the collateral involves a statistically diverse number of borrowers, not simply one borrower.

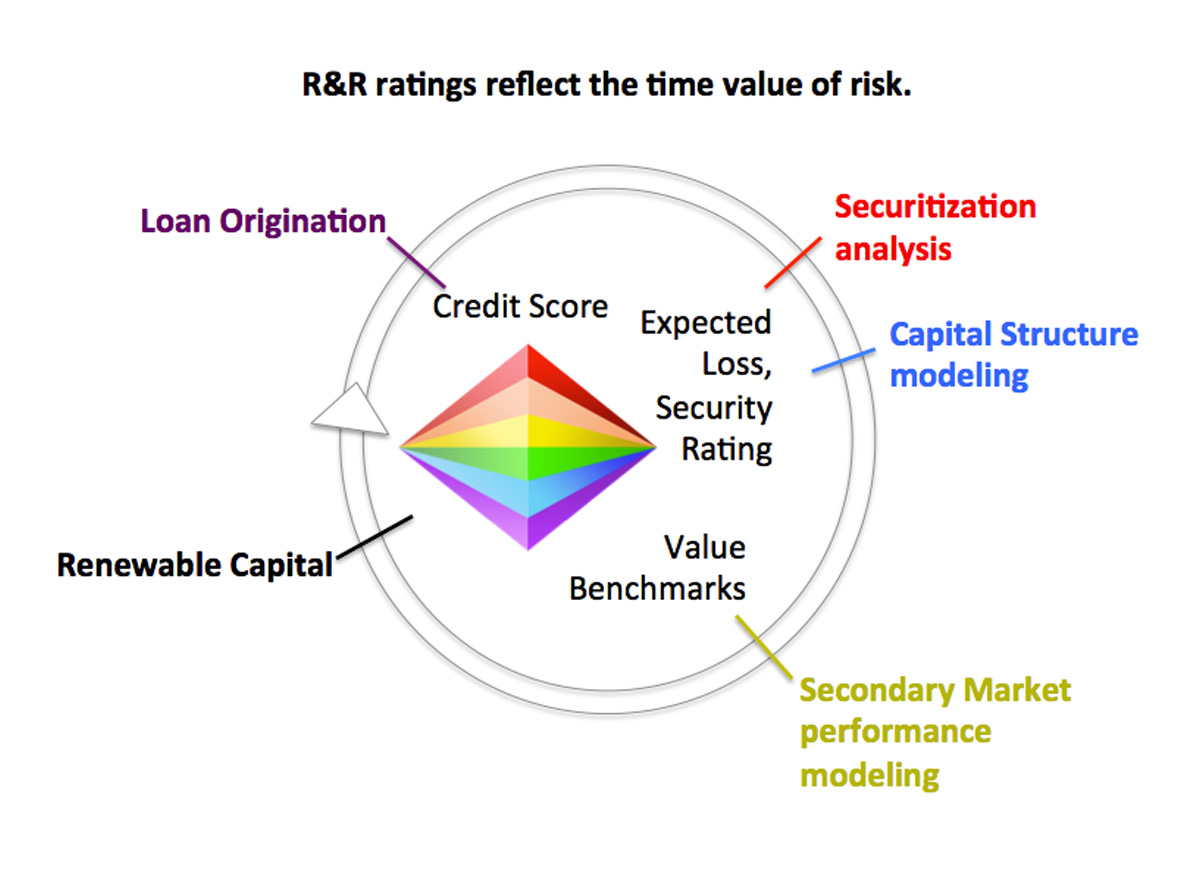

The target rate of return for a structured security is necessarily a function of time, not a parameter determined at closing. The actual rate of return is also a function of time. The closer the actual to target, the greater the efficiency of the capital in the collateral and security structure. The further apart actual and target are, the more fragile the transaction.

CSC believes dynamic monitoring of credit risk in structured securities is vitally important, for pricing and also to minimize moral hazard risk. If ratings are not risk-responsive, securities of deteriorating credit quality will lose value faster than what is reflected in their market prices, and bonds of improving credit quality will appreciate value faster than market prices.

To sum up, bond price is defined with C periodic cash flow collections, the risk-free rate and the credit risk premium, which must reflect time-to-expiration and capital structure deleveraging.

,

[1] Rutledge, Ann E. and Sylvain R. Raynes, Elements of Structured Finance, New York: Oxford University Press, 2010.