12 Jan Digitizing the Credit Rating System

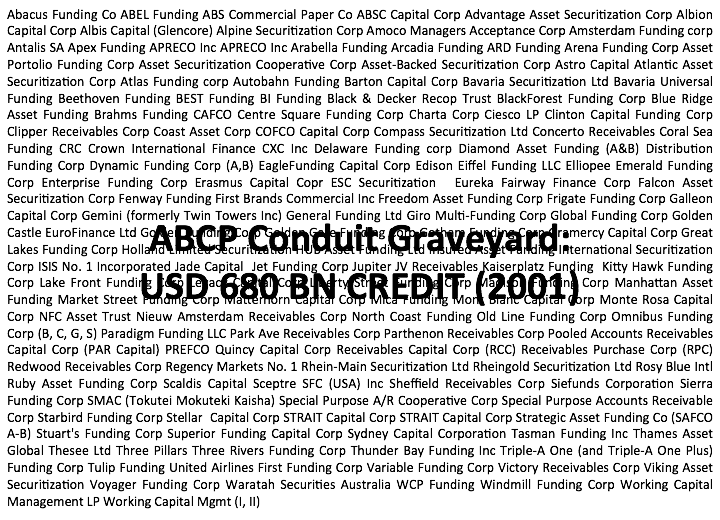

If it is not absurd to talk about digital money, it certainly isn't absurd to talk about digital credit ratings. In fact, there are good reasons to move towards a digital credit rating system sooner rather than later. Here are three:- Digital talks to machines as...